Bootstrapping vs. Venture Capital: Which path is right for your startup

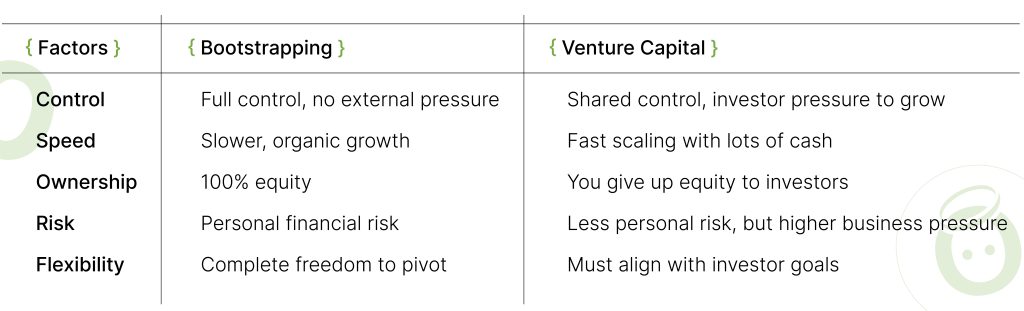

Funding your startup is one of the biggest decisions you’ll make — do you bootstrap and keep full control, or take venture capital for rapid scaling? Each path has trade-offs that will shape your company’s future. Let’s break it down and help you decide.

Deciding between Bootstrapping vs. Venture Capital isn’t just about money — it’s about control, speed, and long-term vision. Bootstrapping means growing at your own pace, relying on revenue rather than investors. Venture Capital, on the other hand, offers rapid funding but comes with expectations for fast scaling and an eventual exit.

Your choice will impact how you build, scale, and run your business. Let’s dive into the key differences and find out which path fits your startup best.

What does Bootstrapping mean?

Bootstrapping means building your startup using personal savings, reinvested profits, or smaller loans, without funding from investors. Many founders, me included, love Bootstrapping because it allows them to have full control over the business and more freedom while making decisions.

However, Bootstrapping also means you’re limited by your financial resources, so your growth might be slower, and in some cases, you might even struggle to survive during difficult times.

Pros of Bootstrapping:

- You control everything: Every decision, from product development to market strategy, is yours to make. There’s no board or investors pushing for faster growth or strategic pivots.

- Sustainable, long-term growth: Bootstrapped companies rely on their own profits for expansion. That’s why they typically grow more cautiously, which can result in a healthier and more resilient business in the long run.

- Keep all your equity: As a Bootstrapped founder, you don’t have to give up any equity in your company, meaning you retain full ownership and the profits that come with it.

Cons of Bootstrapping:

- Limited financial resources: You’ll need to be extremely careful and creative in how you manage cash flow.

- Slower scaling: Without external funding, it can take much longer to expand, hire key personnel, or invest in marketing and product development.

- High personal risk: Bootstrapping means you’re often using your own money or personal loans to fund the business, which can be risky if things don’t go as planned.

What is Venture Capital?

Venture Capital, on the other hand, is external funding from investors, typically in exchange for equity (ownership) in your company.

The appeal of Venture Capital is clear: you get loads of cash that can allow you to scale much faster. On the other hand, you give up part of your ownership and some of your decision-making control.

Pros of Venture Capital:

- Faster scaling potential: With more money, you can hire top talent, invest heavily in marketing, and expand into new markets much faster.

- Access to networks and expertise: Many VCs can connect you to industry experts, potential customers, and other entrepreneurs who can help guide your growth.

- Risk is shared: Instead of risking all your own money, VCs take on part of the risk.

Cons of Venture Capital:

You give up control: Investors will have a say in your strategy and this often means focusing on rapid growth and eventual exits (like an IPO or acquisition) rather than long-term sustainability.

- Pressure to grow fast: VCs want to see quick results. The pressure to hit certain milestones or grow at a rapid pace can lead to stressful decision-making and potential shortcuts that may hurt the business in the long run.

- Dilution of ownership: As you raise more money, you give away more equity, which means your percentage of ownership in the company shrinks over time.

- Time-consuming process: Raising capital can absorb huge amounts of the management team’s time. You’ll need to focus on preparing documents, pitch decks, and investor meetings instead of working on product development and scaling. This opportunity cost can slow your operational progress.

How to decide: Timing and strategy

Choosing between Bootstrapping and Venture Capital isn’t just about pros and cons — it’s also about timing, market conditions, and your vision for the business. The key is to understand when each approach makes sense and how external factors play a role in your decision.

1. Market and competition: Are you in a race?

If your competitors are moving fast and already scaling, you may not have the luxury of going slowly. In this case, Venture Capital might be your only option to keep pace and win the race. On the other hand, if the market is still developing and you have time to build your base, bootstrapping could allow you to grow at a more manageable rate.

2. Business model: What does your industry require?

If you’re in a capital-intensive industry — such as hardware, manufacturing, or medtech — Venture Capital is probably necessary because of high upfront costs. But if you’re in software or a service-based business that can start making money early, bootstrapping might work well.

3. Vision and goals: What do you want to build?

If you’re aiming for an IPO, or to become the biggest company in the world, then Venture Capital might be the right choice. But if you’re more focused on building a business that was your dream or the one that stays true to your values — like sustainability or social impact — Bootstrapping might be the better fit. It gives you the time and space to make sure your company reflects what you believe in.

4. Timing: When is the right moment to raise money?

By bootstrapping as long as you can, you’re able to prove your product and business model, which can give you leverage when you eventually approach investors and save you more equity. You want to raise money only when you’re sure that extra capital will help you grow. I often say: “Bootstrap as long as you see progress.” When you hit that point where capital is the only thing stopping you from growing faster, that’s when VC definitely makes sense

My advice? Keep your proof of concept or MVP as simple as possible. Try to find creative ways to test your product, so you don’t need to raise money until you know it works. Once you’re confident that your product has gained traction, that’s the right time to seek external funding. This approach helps you retain more control and give up less equity when the time comes to raise capital.

Final thoughts

Bootstrapping gives you control and freedom but the growth is slower. Venture Capital provides fuel for rapid growth, but there’s more pressure from investors, which can push you to make decisions you didn’t originally plan for.

The choice between Bootstrapping and Venture Capital isn’t easy, and each option comes with its own set of frustrations.

Both paths are valid, and neither is better than the other — it just depends on your goals, the unique needs of your business, timing and priorities.

As long as you stay true to your core values and keep a close eye on your product, market and competition, you’ll know when it’s the right time to switch gears and seek external funding.

Still unsure which path is right for your startup? Contact us today, and let’s discuss how we can support your growth journey!

Let’s start achieving excellence together

Get in touch with our experts today to turn your ideas into reality and accelerate business growth.